Executive Summary

What is Portugal's IFICI regime (NHR 2.0)?

IFICI (Incentive for Scientific Research and Innovation) is Portugal's replacement for the NHR regime, effective January 1st, 2024. It offers a 20% flat tax rate on qualifying Portuguese income and exemptions on foreign capital gains for 10 years, but eligibility is restricted to highly qualified professionals in innovation, research, and technology sectors.

What is the Article 43-C EBF 14% startup equity regime?

Article 43-C provides a 14% effective tax rate on startup equity capital gains by taxing only 50% of the gain at 28%. It applies to employees of certified startups, SMEs, or R&D-intensive companies, requires a one-year minimum holding period, and defers taxation until share sale.

Can I combine IFICI with Article 43-C benefits?

Yes. IFICI provides the 20% flat rate on employment income, while Article 43-C provides the 14% effective rate on equity capital gains. These regimes operate independently and can be combined for maximum tax efficiency—potentially saving €120K+ on a €500K equity exit.

Portugal's transition from the Non-Habitual Resident (NHR) regime to IFICI represents one of the most significant shifts in European expat taxation. For tech professionals with equity compensation, understanding this new framework is critical—the right structure can save €150K+ over 10 years, while missing eligibility requirements means facing Portugal's standard progressive rates reaching 48% plus solidarity surcharges.1

For comprehensive information on Portugal's general tax framework, see our Portugal country guide. If you're considering a Section 83(b) election for US-granted equity, our Section 83(b) guide for expats covers the 30-day deadline and AMT implications. For comparing stock option types, see our ISO vs NSO guide.

The bottom line: IFICI maintains the attractive 20% flat rate on Portuguese income while dramatically narrowing eligibility to innovation-focused professionals. Combined with Article 43-C's 14% effective rate on startup equity, Portugal offers one of Europe's most favorable tax environments for qualified tech professionals—but only if you meet the strict criteria.2

Critical Warning: The March 31, 2025 deadline for accessing the original NHR regime has passed. New arrivals must qualify for IFICI or face standard Portuguese taxation. Foreign pension income receives no special treatment under IFICI—a major departure from NHR's 10% flat rate.3

The NHR to IFICI Transition: What Changed and Why

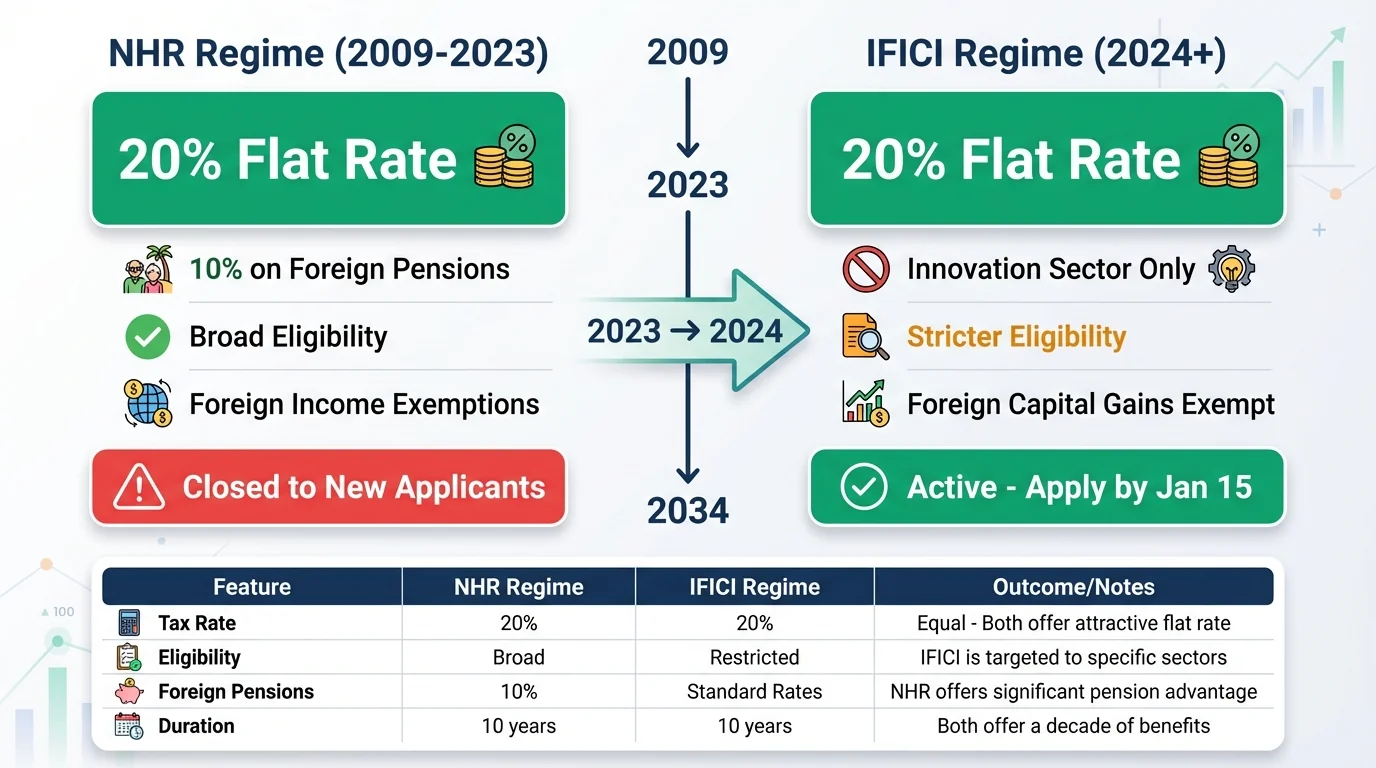

Portugal's original Non-Habitual Resident regime, introduced in 2009, successfully attracted over 10,000 expatriates through exceptionally generous tax benefits.4 The program offered a 20% flat rate on Portuguese income, 10% on foreign pensions, and broad exemptions on foreign-source income—all available to virtually any professional who relocated to Portugal.5

However, by 2023, domestic political pressure regarding housing affordability and fiscal sustainability led to the regime's discontinuation.6 The Portuguese government announced the NHR closure effective January 1st, 2024, with a transition period extending to March 31st, 2025 for individuals who had initiated relocation before the cutoff.7

Timeline of the Transition

| Date | Event |

|---|---|

| 2009 | NHR regime introduced |

| 2023 | Portuguese government announces NHR closure |

| January 1st, 2024 | NHR closed to new applicants; IFICI becomes effective |

| March 31, 2025 | Final deadline for NHR applications (transition period) |

| December 23, 2024 | IFICI implementing regulations published (Ordinance 352-2024-1) |

Source: Portuguese State Budget Law 2024

NHR vs IFICI Comparison: Side-by-side comparison of Portugal's Non-Habitual Resident regime (2009-2023) and the new IFICI regime (2024+). Both offer a 20% flat tax rate, but IFICI has stricter eligibility requirements and removes the 10% foreign pension benefit.

Grandfathering Provisions

Individuals who successfully registered for NHR status before March 31, 2025 continue to enjoy their original benefits for the full 10-year period.8 This creates a two-tiered system where existing NHR beneficiaries maintain superior tax treatment compared to new arrivals who must qualify for IFICI.9

Key Transition Requirements:

- Portuguese tax residency established by December 31, 2023, OR

- Evidence of relocation commitment before regime closure (employment contracts dated before December 31, 2023, property purchases before October 10, 2023, visa applications initiated before closure)

Source: Portuguese Tax Authority Transition Guidance

IFICI Tax Benefits: The 20% Flat Rate and Foreign Income Exemptions

The cornerstone of the IFICI regime is a flat 20% personal income tax rate applied to qualifying Portuguese-source employment income (Category A) and professional self-employment income (Category B), compared to Portugal's standard progressive rates reaching 48% for high earners.10

Tax Rate Comparison

| Income Level | Standard Portuguese Rate | IFICI Rate | Annual Savings (€100K income example) |

|---|---|---|---|

| €50,000 | 26.5% marginal | 20% + 2.5% solidarity | €4,000 |

| €100,000 | 44.6% marginal | 20% + 2.5% solidarity | €22,100 |

| €200,000 | 48% + 5% solidarity | 20% + 5% solidarity | €56,000 |

Source: Portuguese Personal Income Tax Code (CIRS)

Solidarity Surcharges

Portugal imposes additional solidarity surcharges that apply to IFICI beneficiaries:11

- 2.5% on taxable income exceeding €80,000

- 5% on taxable income exceeding €250,000

Therefore, an IFICI beneficiary earning €100,000 pays approximately 22.5% combined (20% + 2.5% solidarity), still substantially lower than the 44.6% marginal rate under standard taxation.12

Foreign-Source Income Exemptions

IFICI provides sweeping exemptions on foreign-source income, including:13

| Income Category | IFICI Treatment | NHR Treatment |

|---|---|---|

| Foreign employment income | Exempt (if treaty country) | Exempt (if treaty country) |

| Foreign capital gains | Exempt (if treaty country) | Exempt (conditional) |

| Foreign dividends/interest | Exempt (if treaty country) | Exempt (if treaty country) |

| Foreign pension income | Standard progressive rates | 10% flat rate |

| Blacklisted jurisdictions | 35% flat rate | Standard rates |

Critical Difference: Foreign pension income receives no special treatment under IFICI—a retiree with €60,000 annual pension pays approximately €22,800 under IFICI versus €6,000 under NHR (nearly a four-fold increase).14

Source: Portuguese Ordinance 352-2024-1, Article 58-A

Article 43-C EBF: The 14% Effective Rate on Startup Equity

Portugal's Article 43-C regime, established through Law 21/2023 of May 25, 2023, offers one of Europe's most favorable tax treatments for startup equity compensation.15 The regime operates by taxing only 50% of capital gains at a 28% rate, resulting in an effective tax rate of 14%.16

How the 14% Rate Works

The mathematical structure:

Effective Rate = (50% of gain) × 28% = 14% of total gain

Example Calculation:

| Event | Standard Treatment | Article 43-C Treatment |

|---|---|---|

| Exercise at $10, FMV $50 | — | — |

| Sale at $100/share | — | — |

| Total gain | $90/share | $90/share |

| Taxable portion | $90/share (100%) | $45/share (50%) |

| Tax at 28% | $25.20/share | $12.60/share |

| Effective Rate | 28% | 14% |

Source: Portuguese Law 21/2023, Article 43-C

Company Eligibility Requirements

Companies must meet at least one of the following criteria:17

| Pathway | Requirements |

|---|---|

| Certified Startup | Registered with Startup Portugal, fewer than 10 years old, fewer than 250 employees, fewer than €50M turnover |

| SME/Small-mid-cap | fewer than 500 employees OR fewer than €50M turnover OR fewer than €43M balance sheet |

| R&D Intensive | R&D expenses ≥10% of total expenses or turnover |

| Innovation Recognition | Recognized by ANI (National Innovation Agency) or completed VC funding round |

Portuguese Presence Requirement: Companies must have headquarters in Portugal OR employ at least 25 individuals in Portugal.18

Source: Startup Portugal Certification Manual

Employee Eligibility and Restrictions

Eligible Participants:

- Employees actively involved in company operations

- Members of corporate bodies (board members, executives)

Exclusions:

- Contractors and Employer of Record (EOR) arrangements

- Shareholders holding 20% or more of share capital or voting rights (directly or indirectly)

- Officers/directors of micro/small enterprises (for plans approved before January 1st, 2023)

Minimum Holding Period: Shares must be held for at least one year from exercise date to qualify for the 14% rate.19

Source: Portuguese Tax Benefits Statute (EBF), Article 43-C

Tax Deferral Until Sale

Unlike standard stock option taxation (taxed at exercise), Article 43-C defers taxation until one of three events:20

- Sale of shares (most common)

- Gratuitous transfer (gift, donation, inheritance)

- Loss of Portuguese tax residency

This deferral aligns tax timing with actual liquidity events, avoiding cash flow challenges from taxing paper gains.

Equity Compensation Taxation Under IFICI

The treatment of stock options, RSUs, and capital gains under IFICI creates both opportunities and complexities for tech professionals.

Stock Options Taxation

Non-Qualified Stock Options:

- Taxation occurs at exercise (spread between FMV and exercise price)

- Taxed as employment income at 20% flat rate under IFICI (if Portuguese-sourced)

- Subsequent gains on sale taxed as capital gains (28% standard or 14% if Article 43-C applies)

Qualified Stock Options (Article 43-C):

- Taxation deferred until sale

- Effective rate of 14% if holding period met (1 year minimum)

- Requires company to qualify as startup/SME/R&D intensive

| Option Type | Exercise Event | Sale Event | Total Effective Rate |

|---|---|---|---|

| Non-qualified (standard) | 20% (IFICI) or progressive | 28% capital gains | ~40-45% combined |

| Qualified (Article 43-C) | Deferred | 14% effective | 14% total |

Source: DLA Piper Portugal Equity Compensation Analysis

RSU Taxation

Restricted Stock Units are taxed at vesting as employment income:21

| Event | Tax Treatment |

|---|---|

| Vesting | Employment income at 20% flat rate (IFICI) or progressive rates |

| Sale (held more than one year) | Capital gains at 28% standard or 14% (Article 43-C) |

| Sale (held less than one year) | Progressive income tax rates if total income exceeds threshold |

Key Difference: RSUs trigger immediate taxation at vesting regardless of when shares are sold, unlike qualified stock options which defer taxation until sale.

Source: Portuguese Personal Income Tax Code, Category A

Capital Gains Treatment

Portuguese-Source Capital Gains:

- Standard rate: 28% flat

- Article 43-C: 14% effective (if qualified)

- Long-holding exclusions: 10% (2-5 years), 20% (5-8 years), 30% (8+ years)

Foreign-Source Capital Gains (IFICI):

- Exempt if sourced from treaty countries or countries with taxing rights

- Must be reported but not taxed

- Blacklisted jurisdictions: 35% flat rate

Source: Portuguese Ordinance 352-2024-1

US-Portugal Tax Treaty: Article 13 and Article 14 Implications

The US-Portugal Income Tax Treaty, signed in 1994 and effective January 1st, 1996, governs cross-border taxation of equity compensation and capital gains.22

Article 14: Capital Gains Allocation

Article 14, paragraph 6 provides that gains from the alienation of property (other than real property or business property) are taxable only in the country of residence.23

Implication for US Citizens: The treaty's "savings clause" permits the US to tax its citizens regardless of treaty provisions, meaning US citizens face potential taxation in both countries.24 However, recent arbitration decisions suggest that US citizens in Portugal may claim IFICI exemptions on foreign capital gains because the US maintains taxing rights under the savings clause.25

| Scenario | US Tax | Portuguese Tax | Relief Mechanism |

|---|---|---|---|

| US citizen, Portuguese resident, sells US stock | 20% LTCG | Exempt (IFICI) | Foreign Tax Credit (if applicable) |

| US citizen, Portuguese resident, sells Portuguese stock | 20% LTCG | 28% standard / 14% (Article 43-C) | Foreign Tax Credit reduces US tax |

| Non-US person, Portuguese resident, sells US stock | 0% (non-resident) | Exempt (IFICI) | No double taxation |

Source: US-Portugal Tax Treaty, Article 14

Article 13: Royalties

Article 13 addresses royalties, which may become relevant for equity arrangements involving intellectual property or technology transfers.26 Withholding taxes on royalties are limited to 10% under the treaty.27

Sourcing Rules for Equity Compensation

The treaty does not specify sourcing methodologies, so both countries apply domestic rules:28

US Approach: Grant-to-vest method (benefit allocated based on workdays from grant to vesting)

Portuguese Approach: Generally sources to where employment is performed

Planning Consideration: Employees working in multiple jurisdictions during vesting periods may face complex sourcing allocations requiring professional tax advice.

Source: OECD Model Tax Convention Commentary

NHR vs IFICI: Detailed Comparison for Equity Holders

The transition from NHR to IFICI creates dramatically different outcomes for equity compensation recipients.

Side-by-Side Comparison

| Feature | NHR (2009-2023) | IFICI (2024+) |

|---|---|---|

| Flat rate on Portuguese income | 20% | 20% |

| Foreign pension income | 10% flat | Standard progressive (13-48%) |

| Foreign capital gains | Exempt (conditional) | Exempt (conditional) |

| Eligibility scope | Broad (any profession) | Narrow (innovation sectors only) |

| Employer requirements | None | Export 50%+ OR startup certification OR R&D intensive |

| Duration | 10 years | 10 years |

| Application complexity | Low (centralized) | High (multiple agencies) |

Winners and Losers

Winners Under IFICI:

- ✅ Highly skilled professionals in innovation sectors (scientists, researchers, tech specialists)

- ✅ Startup founders and employees (access to Article 43-C's 14% rate)

- ✅ Professionals with foreign capital gains (enhanced exemption clarity)

Losers Under IFICI:

- ❌ Retirees (pension income loses 10% flat rate)

- ❌ Digital nomads and freelancers (no longer eligible)

- ❌ Passive investors (must develop qualifying employment)

- ❌ Professionals outside innovation sectors

Numerical Example: €500K Equity Exit

Scenario: Tech professional sells startup equity for €500,000 gain

| Regime | Portuguese Tax | Foreign Tax Credit | Net Tax |

|---|---|---|---|

| NHR | €0 (exempt if foreign-sourced) | N/A | €0 |

| IFICI | €0 (exempt if foreign-sourced) | N/A | €0 |

| Article 43-C | €70,000 (14% effective) | Potentially available | €70,000 |

| Standard Portuguese | €140,000 (28%) | Potentially available | €140,000 |

Key Insight: For Portuguese-sourced equity, Article 43-C provides substantial savings (€70K vs €140K). For foreign-sourced equity, both NHR and IFICI provide exemptions, but IFICI requires meeting stricter eligibility criteria.

Source: KPMG Portugal Tax Alert 2025

Application Process and Deadlines

Accessing IFICI benefits requires navigating a more complex administrative process than the original NHR regime.

Application Deadlines

| Residency Year | Application Deadline | Notes |

|---|---|---|

| 2024 | March 15, 2025 | Extended transition deadline |

| 2025 and later | January 15 of following year | Standard deadline |

Critical: Applications must be submitted through the Finance Portal (Portal das Finanças) with comprehensive documentation.29

Verification Agencies

IFICI uses a decentralized verification system:30

| Activity Category | Verification Agency | Contact |

|---|---|---|

| Scientific research & teaching | FCT (Foundation for Science and Technology) | fct.pt |

| Productive investment (large companies) | AICEP (Trade & Investment Agency) | aicep.pt |

| Productive investment (SMEs) | IAPMEI (Agency for Competitiveness) | iapmei.pt |

| Startup employees | Startup Portugal | startupportugal.pt |

| Tech/Innovation centers | ANI (National Innovation Agency) | ani.pt |

Required Documentation

For IFICI Application:

- ✅ Proof of Portuguese tax residency

- ✅ Certificate of non-residency in Portugal (5 years prior)

- ✅ Employment contract or professional service agreement

- ✅ Educational qualifications (Level 6 EQF + 3 years experience OR Level 8 EQF)

- ✅ Employer certification (export status, startup certification, or R&D evidence)

- ✅ Verification declaration from competent agency

For Article 43-C Qualification:

- ✅ Startup Portugal certification (if applicable)

- ✅ Equity plan documentation

- ✅ Proof of holding period (one year minimum)

- ✅ Evidence of company eligibility (size, R&D, innovation)

Source: Portuguese Tax Authority IFICI Application Guide

Application Checklist

- ☐ Verify tax residency establishment date

- ☐ Determine qualifying activity category

- ☐ Identify correct verification agency

- ☐ Gather all required documentation

- ☐ Submit application by deadline (January 15 or March 15, 2025)

- ☐ Track verification agency review (typically 10-30 days)

- ☐ Receive Tax Authority confirmation (by March 31 or April 30)

- ☐ Maintain records for 7+ years

Strategic Tax Planning for Equity Compensation

Combining IFICI eligibility with Article 43-C creates powerful tax optimization opportunities for tech professionals.

Strategy: Timing Equity Grants

Optimal Timing:

- Establish Portuguese tax residency before receiving equity grants

- Ensure grants occur after IFICI approval

- Structure grants to qualify for Article 43-C treatment

Avoid:

- Receiving grants before establishing Portuguese residency (may create foreign-source characterization)

- Missing IFICI application deadlines

- Structuring equity in ways that disqualify Article 43-C benefits

Strategy 2: Combining IFICI + Article 43-C

Maximum Benefit Structure:

| Component | Treatment | Effective Rate |

|---|---|---|

| Portuguese employment income | IFICI 20% flat | 20% + solidarity |

| Equity compensation (Portuguese startup) | Article 43-C deferred + 14% | 14% effective |

| Foreign capital gains | IFICI exemption | 0% |

Example: Tech professional earning €150K salary + €500K equity exit

- Salary tax: €150K × 22.5% = €33,750

- Equity tax: €500K × 14% = €70,000

- Total tax: €103,750 vs €224,000 under standard rates

- Savings: €120,250

Source: PWC Portugal Tax Planning Guide

Strategy 3: US Citizens - Foreign Tax Credit Optimization

US citizens in Portugal can optimize through:

- Claim IFICI exemption on foreign capital gains (Portugal)

- Pay US tax at 20% LTCG rate

- Use Foreign Tax Credit for any Portuguese taxes paid on Portuguese-sourced income

- Result: Effective rate limited to higher of US or Portuguese rate

Example: US citizen sells US stock for $1 million gain

- US tax: $200,000 (20% LTCG)

- Portuguese tax: €0 (IFICI exemption)

- Total: $200,000 vs $280,000 if taxed in both countries

Strategy 4: Structuring Equity for Article 43-C

Requirements Checklist:

- ☐ Company qualifies as startup/SME/R&D intensive

- ☐ Employee holds fewer than 20% ownership

- ☐ Formal equity plan documentation

- ☐ Minimum one-year holding period planned

- ☐ Portuguese presence requirement met

Common Mistakes to Avoid:

- ❌ Granting to contractors (disqualifies Article 43-C)

- ❌ Founders holding more than 20% (excluded from benefits)

- ❌ Selling before one-year holding period

- ❌ Missing startup certification requirements

Frequently Asked Questions

Who qualifies for IFICI?

IFICI eligibility requires:31

- Portuguese tax residency established after January 1st, 2024

- No Portuguese tax residency in the 5 years prior

- Highly qualified profession in innovation/research/technology sectors

- Employment with qualifying entity (export 50%+, startup, R&D intensive, or recognized institution)

- Level 6 EQF qualification + 3 years experience OR Level 8 EQF qualification

Source: Portuguese Ordinance 352-2024-1, Article 58-A

Can I combine IFICI with Article 43-C benefits?

Yes. IFICI provides the 20% flat rate on employment income, while Article 43-C provides the 14% effective rate on equity capital gains. These regimes operate independently and can be combined for maximum tax efficiency.32

How are foreign capital gains taxed under IFICI?

Foreign capital gains are exempt from Portuguese taxation under IFICI if:33

- The gain is sourced from a country with a double taxation treaty with Portugal, OR

- The gain is taxable in the source country under applicable tax law

- The source country is not on Portugal's tax haven blacklist

Gains from blacklisted jurisdictions face a 35% flat rate.

What happens after the 10-year IFICI period ends?

After 10 years, IFICI benefits terminate and you become subject to standard Portuguese taxation on worldwide income.34 This includes:

- Progressive rates up to 48% + solidarity surcharges

- 28% capital gains rate (or 14% if Article 43-C still applies)

- No exemptions on foreign income

Planning Consideration: Consider structuring investments through tax-efficient vehicles (life insurance bonds, etc.) before the 10-year period expires.

Can I still access the original NHR regime?

No. The deadline for NHR applications was March 31, 2025. Only individuals who successfully registered before this date continue to benefit from NHR for their remaining 10-year period.35 New arrivals must qualify for IFICI or face standard Portuguese taxation.

How does Article 43-C differ from standard capital gains taxation?

Article 43-C provides:36

- Tax deferral until sale (vs. taxation at exercise for non-qualified options)

- 50% exemption on capital gains (vs. full taxation)

- 14% effective rate (vs. 28% standard rate)

- Requires company and employee eligibility + one-year holding period

Are RSUs eligible for Article 43-C treatment?

RSUs are taxed at vesting as employment income (20% under IFICI or progressive rates). The subsequent capital gains portion may qualify for Article 43-C's 14% rate if the company qualifies and holding period requirements are met.37

What is the difference between IFICI and NHR for equity compensation?

| Aspect | NHR | IFICI |

|---|---|---|

| Eligibility | Broad (any profession) | Narrow (innovation sectors) |

| Portuguese income rate | 20% flat | 20% flat |

| Foreign capital gains | Exempt (conditional) | Exempt (conditional) |

| Foreign pensions | 10% flat | Standard progressive |

| Application complexity | Low | High (multiple agencies) |

How do I prove my company qualifies for Article 43-C?

Companies must obtain:38

- Startup certification from Startup Portugal (if applicable), OR

- Documentation proving SME status (fewer than 500 employees, fewer than €50M turnover), OR

- Evidence of R&D intensity (≥10% of expenses/turnover), OR

- Recognition from ANI or proof of VC funding

Can US citizens benefit from IFICI exemptions?

Yes, but US citizens face additional complexity due to citizenship-based taxation.39 Recent arbitration decisions suggest US citizens may claim IFICI exemptions on foreign capital gains because the US maintains taxing rights under the treaty's savings clause, even though Article 14, paragraph 6 would otherwise allocate taxing rights to Portugal.

What documentation do I need for IFICI application?

Required documentation includes:40

- Portuguese tax residency certificate

- Non-residency certificate (5 years prior)

- Employment contract

- Educational qualifications

- Employer certification (export status, startup status, or R&D evidence)

- Verification declaration from competent agency (FCT, AICEP, IAPMEI, ANI, or Startup Portugal)

Footnotes

Disclaimer: This guide discusses legal tax optimization strategies only. Tax evasion is illegal and is never recommended. This content is for educational purposes and does not constitute tax, legal, or financial advice. Tax laws vary by jurisdiction and change frequently. Always consult a qualified tax professional (CPA, tax attorney, enrolled agent) specializing in Portuguese taxation before making decisions based on this information. The authors accept no liability for actions taken based on this content.

Primary Sources

Last Updated: January 2026 | Research Team: VestingStrategy

Footnotes

-

Portuguese Ordinance 352-2024-1 establishes IFICI regime effective January 1st, 2024. See Official Gazette. ↩

-

Portuguese Law 21/2023 introduces Article 43-C EBF providing 14% effective rate on startup equity. See Law 21/2023. ↩

-

Portuguese State Budget Law 2024 closed NHR regime effective January 1st, 2024, with transition period to March 31st, 2025. ↩

-

Portuguese Tax Authority statistics indicate over 10,000 NHR beneficiaries registered between 2009-2023. ↩

-

Original NHR regime provided 20% flat rate on Portuguese income, 10% on foreign pensions, and broad exemptions on foreign-source income per Portuguese Tax Benefits Statute. ↩

-

Domestic political pressure regarding housing affordability and fiscal sustainability (€1.7B annual cost) led to NHR closure per Portuguese government announcements. ↩

-

Transition period requirements specified in Portuguese Tax Authority guidance, requiring evidence of relocation commitment before regime closure. ↩

-

Grandfathering provisions ensure existing NHR beneficiaries maintain benefits through full 10-year period per Portuguese Tax Authority confirmations. ↩

-

Two-tiered system creates differential treatment between NHR beneficiaries (until 2033+) and new IFICI applicants. ↩

-

Portuguese Personal Income Tax Code (CIRS) establishes progressive rates reaching 48% plus solidarity surcharges of 2.5-5% for high earners. ↩

-

Solidarity surcharges apply independently of IFICI flat rate per Portuguese Tax Code provisions. ↩

-

Combined IFICI rate calculation: 20% base + 2.5% solidarity (€80K-€250K) = 22.5% effective rate. ↩

-

Portuguese Ordinance 352-2024-1, Article 58-A specifies foreign-source income exemptions conditional on treaty status and blacklist exclusion. ↩

-

Pension income taxation comparison: NHR 10% flat rate (€6,000 on €60K) vs IFICI progressive rates (approximately €22,800 on €60K) per Portuguese tax calculations. ↩

-

Portuguese Law 21/2023, Article 43-C establishes startup equity tax regime effective May 26, 2023, with retroactive application to January 1st, 2023 for qualifying plans. ↩

-

Article 43-C calculation: 50% of capital gain × 28% rate = 14% effective rate on total gain per Portuguese Tax Benefits Statute. ↩

-

Company eligibility requirements specified in Portuguese Law 21/2023 and Startup Portugal certification procedures. ↩

-

Portuguese presence requirement ensures tax benefits support domestic employment and economic activity per Portuguese Law 21/2023. ↩

-

Minimum holding period of one year from exercise date required for Article 43-C benefits per Portuguese Tax Benefits Statute. ↩

-

Tax deferral provisions specified in Portuguese Law 21/2023, Article 43-C, deferring taxation until sale, transfer, or residency loss. ↩

-

RSU taxation occurs at vesting per Portuguese Personal Income Tax Code, Category A (employment income). ↩

-

US-Portugal Income Tax Treaty signed 1994, effective January 1st, 1996. See IRS Treaty Documents. ↩

-

US-Portugal Tax Treaty, Article 14, paragraph 6 allocates capital gains taxation to country of residence for property other than real property or business property. ↩

-

Treaty Protocol Paragraph one, subparagraph (b) contains savings clause permitting US taxation of citizens regardless of treaty allocations. ↩

-

Lisbon Administrative Arbitration Court (CAAD) decision suggests US citizens may claim IFICI exemptions on foreign capital gains due to US savings clause maintaining taxing rights. ↩

-

US-Portugal Tax Treaty, Article 13 addresses royalties, limiting withholding taxes to 10% of gross amount. ↩

-

Royalty withholding tax limitation per US-Portugal Tax Treaty, Article 13, paragraph 2. ↩

-

OECD Model Tax Convention Commentary provides guidance on sourcing methodologies for equity compensation, with countries applying domestic rules absent treaty specifications. ↩

-

Portuguese Tax Authority Finance Portal (Portal das Finanças) serves as application submission platform for IFICI registration. ↩

-

Decentralized verification system assigns different agencies to evaluate eligibility based on activity category per Portuguese Ordinance 352-2024-1. ↩

-

IFICI eligibility requirements specified in Portuguese Ordinance 352-2024-1, Article 58-A, requiring Portuguese tax residency, professional qualifications, and qualifying employment. ↩

-

IFICI and Article 43-C operate independently, allowing combination of 20% employment income rate with 14% equity capital gains rate. ↩

-

Foreign capital gains exemption conditions specified in Portuguese Ordinance 352-2024-1, requiring treaty country status or source country taxing rights, excluding blacklisted jurisdictions. ↩

-

IFICI benefits terminate after 10 consecutive calendar years per Portuguese Ordinance 352-2024-1, with no renewal provisions. ↩

-

NHR application deadline of March 31, 2025 established in Portuguese Tax Authority transition guidance, closing original regime to new applicants. ↩

-

Article 43-C benefits include tax deferral, 50% exemption, and 14% effective rate compared to standard 28% capital gains rate per Portuguese Law 21/2023. ↩

-

RSU vesting triggers employment income taxation, with subsequent capital gains potentially qualifying for Article 43-C if company and holding period requirements met. ↩

-

Company qualification documentation requirements specified in Portuguese Law 21/2023 and Startup Portugal certification procedures. ↩

-

US citizenship-based taxation creates additional complexity for IFICI beneficiaries, requiring coordination with US tax obligations and foreign tax credit mechanisms. ↩

-

IFICI application documentation requirements specified in Portuguese Tax Authority guidance and Ordinance 352-2024-1 implementation procedures. ↩